Views: 0 Author: Site Editor Publish Time: 2025-03-06 Origin: Site

The calcium silicate board market size is growing with a CAGR of 4.3% during the forecast period (2025-2032), and the market is projected to be valued at USD 2,888.40 Million by 2032 from USD 2,065.11 Million in 2024. Additionally, the market value for the 2025 attributes to USD 2,147.17 Million.

The calcium silicate board is a high-performance, durable and fire resistance building material. It is made from a mixture of calcium, silica, cement, and reinforcing fibers. This board possesses properties such as moisture resistance, chemical resistance and good thermal insulation. It comes in various types based on the density such as high density, medium density and low density. It is used in various industries including construction, energy & power, petrochemical, and others. This board is distributed through direct sales, retail sales, and online sales to power plants, steel manufacturers, and construction companies. Additionally, demand for non-toxic and eco-friendly insulation material including calcium silicate board is rising further driving the market expansion.

The construction sector refers to the planning, building, and maintenance of buildings, highways, and other physical structures. In this sector, calcium silicate board is used for walls, ceilings, and floors to provide fire resistance and thermal insulation in commercial and residential buildings. The construction sector is growing due to rising population, rising government support and urbanization further driving the market.

In 2023, according to Mapei S.p.A., global construction represented a growth of 3.4% as compared to the year 2022. This growing construction is driving the use of calcium silicate board for wall cladding to provide an excellent protective layer for exterior walls.

Hence, the growing construction sector is leading to calcium silicate board market demand.

In solar panel manufacturing, calcium silicate board is incorporated to provide thermal insulation and protection for the photovoltaic cells. It also provides moisture resistance to maintain structural integrity in solar panels. The solar panel manufacturing is growing supported by rising focus on sustainability and technological advancements, further driving the market.

In 2024, according to Solar Energy Industries Association, the solar panel manufacturing in United States is increased by 71% as compared to the year 2023. This is driving the use of calcium silicate boards in solar panel manufacturing to reduce heat loss and improve energy efficiency.

Hence, rising adoption in solar power capacity is leading to calcium silicate board market expansion.

Commercialization of alternative boards such as cement boards and gypsum boards are growing. They provide similar thermal insulation and fire resistance as that of calcium silicate board. Compared to this board, gypsum board has low installation cost and easy to replace making it more suitable for ceiling and walls. Further, the gypsum board is lighter in weight making handling and installation easier. Additionally, the use of cement boards is growing in a high impact environment due to its ability to perform well under mechanical stress. Hence, the adoption of alternative boards such as cement boards and gypsum boards are constraining the market due to low installation cost and easy replacement.

In petrochemical sector chemical compounds are derived from crude oil & natural gas. In this sector, calcium silicate board is used for protecting surfaces from exposure to corrosive chemicals, acids, and alkalis. This board also provides thermal insulation and fire resistance. The petrochemical sector is witnessing significant growth supported by government initiatives, sustainability, and digital innovation.

According to Indian Chemical News, the petrochemical sector in India is expected to grow with a CAGR of 8.78% by 2040 from 2022. This growth will create opportunities for the market due to growing preference insulation materials with better thermal conductivity and fireproofing.

Hence, expanding petrochemical sector is expected to create calcium silicate board market opportunities supported by growing preference for non-toxic insulation material.

Based on product type, the market is categorized into high density, medium density and low density.

Trends in Product Type:

According to calcium silicate board market trends, high density board is highly utilized in steel production to provide slag resistance and fire-resistant barriers.

Adoption of low-density boards is growing due to its lightweight properties and easy transportation as per market trends.

The high density segment accounted for the largest market share in the year 2024.

High density calcium silicate board is high strength insulation board with a density of 1250 kg/m³.

It is designed specifically for thermal insulation and fireproofing in aluminum casting, foundry making and crude steel production.

Further, construction of commercial buildings, manufacturing plants, and residential spaces is growing which leads to demand for crude steel. To cater this, countries are expanding their crude steel production.

For instance, in 2024, according to World Steel Association, the crude steel production in Europe is increased by 2.6% as compared to the year 2023. This is driving the use of this high-density board to provide slag resistance and fire-resistant barriers in steel production.

Hence, high density segment is dominating in the market, supported by growing steel sector and economic development.

The low density segment is expected to grow at the fastest CAGR over the forecast period.

The low density calcium silicate board is lightweight insulation board with density less than 0.1 kg/m³.

It has low thermal insulation properties and low thermal conductivity.

The lightweight nature of this board simplifies transportation and installation, reducing overall construction cost.

As industries focus on sustainability, the adoption of this board is growing due to its eco-friendly composition and recyclability.

The demand is also rising in heating, ventilation, and air conditioning (HVAC) and power generation sectors, where it helps improve energy efficiency by minimizing heat loss.

Hence, adoption of low density board is increasing in power generation sectors supported by easy transportation further driving the growth of the segment.

Based on end-use, the market is categorized into construction, energy & power, petrochemical, and others.

Trends in End-Use:

As per calcium silicate board market trends, calcium silicate board is widely utilized in construction for moisture resistance and acoustic insulation.

Use of calcium silicate board is growing in petrochemical plants for reducing energy consumption by maintaining stable operating temperatures as per market trends.

The construction segment accounted for the largest market share in the year 2024.

The calcium silicate board is highly utilized in the construction for acoustic insulation, reducing noise transmission in commercial buildings, offices, and residential spaces.

Due to the moisture resistance properties of this board, it is also used for humid environments such as bathrooms, kitchens, and basements for preventing mold growth.

Additionally, this board supports high-quality finishing due to its smooth surface, allowing easy application of paints, wallpapers, and decorative laminates in construction.

Hence, construction segment is dominating in the end-use supported by acoustic insulation and moisture resistance properties of calcium silicate board.

The petrochemical segment is expected to grow at the fastest CAGR over the forecast period.

In petrochemicals calcium silicate board is utilized for the corrosion resistance. It also protects surfaces from harsh chemicals, acids and solvents.

The population and industrialization is growing which is leading to more demand for petrochemicals. To cater for this, the government is investing in petrochemical sector.

For instance, according to Environmental and Energy Study Institute, the government invested USD 121 million in petrochemical sector in United States. This investment is facilitating the use of calcium silicate board for reducing energy consumption by maintaining stable operating temperatures and improving overall petrochemical plant efficiency.

Hence, adoption of this board is growing in the petrochemical sector supported by government investments further driving the growth of the segment.

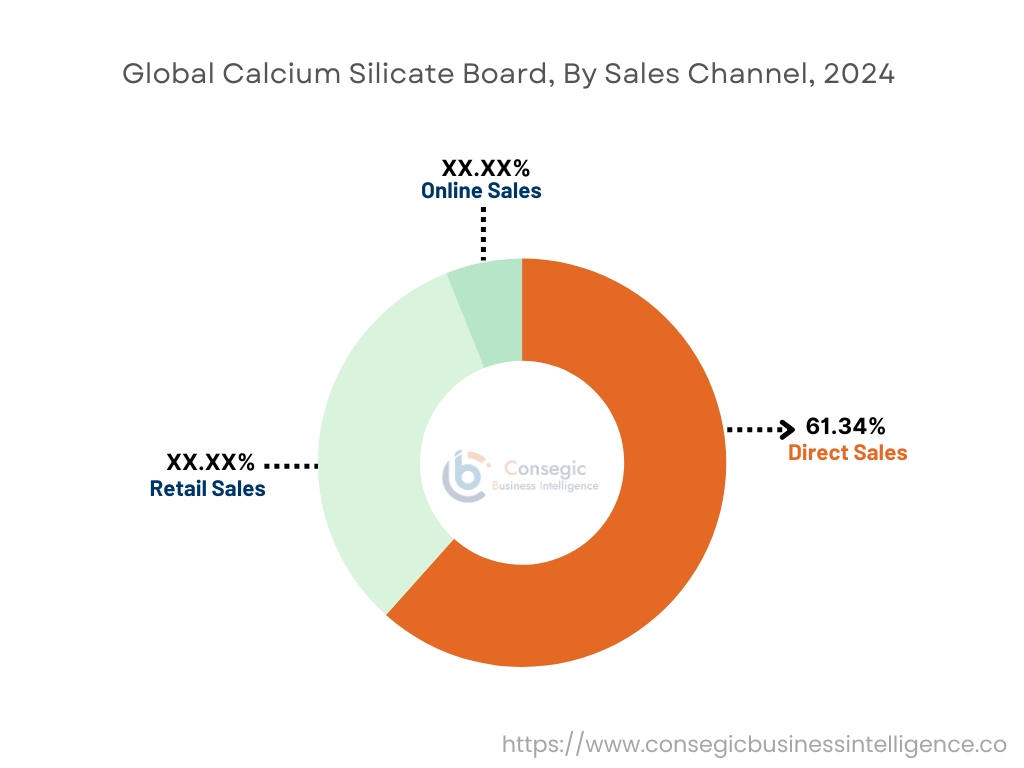

Based on Sales channel, the market is categorized into direct sales, retail sales, and online sales.

Trends in Sales Channel:

Calcium silicate board is widely distributed through direct sales to construction companies and steel manufacturers ensuring bulk and consistent product supply.

Adoption of online sales is growing for the sale of this board due to wider reach and customer convenience as per market trends.

The direct sales segment accounted for the largest market share of 61.34% in the year 2024.

Direct sales are a type of sales channel where products are sold directly to customers without any intermediaries.

Calcium silicate board is widely distributed through direct sales to oil & gas companies, power generation plants, and construction companies directly.

It helps to build strong relationships with customers and ensures control over the entire sales process, from pricing to delivery, ensuring higher margins and personalized offerings.

Direct sales provide a bulk amount of this board to the real-estate cooperatives, ensuring better product quality and consistent supply.

Thus, the direct sales segment is dominating in the Sales channel supported by ensuring bulk supply and better product quality to the customers.

The online sales segment is expected to grow at the fastest CAGR over the forecast period.

Online sales are a type of sales channel that refers to the selling of goods and services online through digital platforms and marketplaces.

The sale of calcium silicate board through online sales is growing due to wider reach and customer convenience.

Further, the digitalization and greater access to the global market has led to the widespread adoption of online sales by comparing products of various brands with detailed description and user reviews.

For instance, in 2022, according to International Trade Administration, the online sales in Germany is increased by 11% as compared to the year 2021. This includes calcium silicate board which is distributed through online sales to construction companies, steel manufacturers, and power generation plants.

Thus, the adoption of online sales is growing in the market due to wider customer reach and detailed product descriptions.

The regional segment includes North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

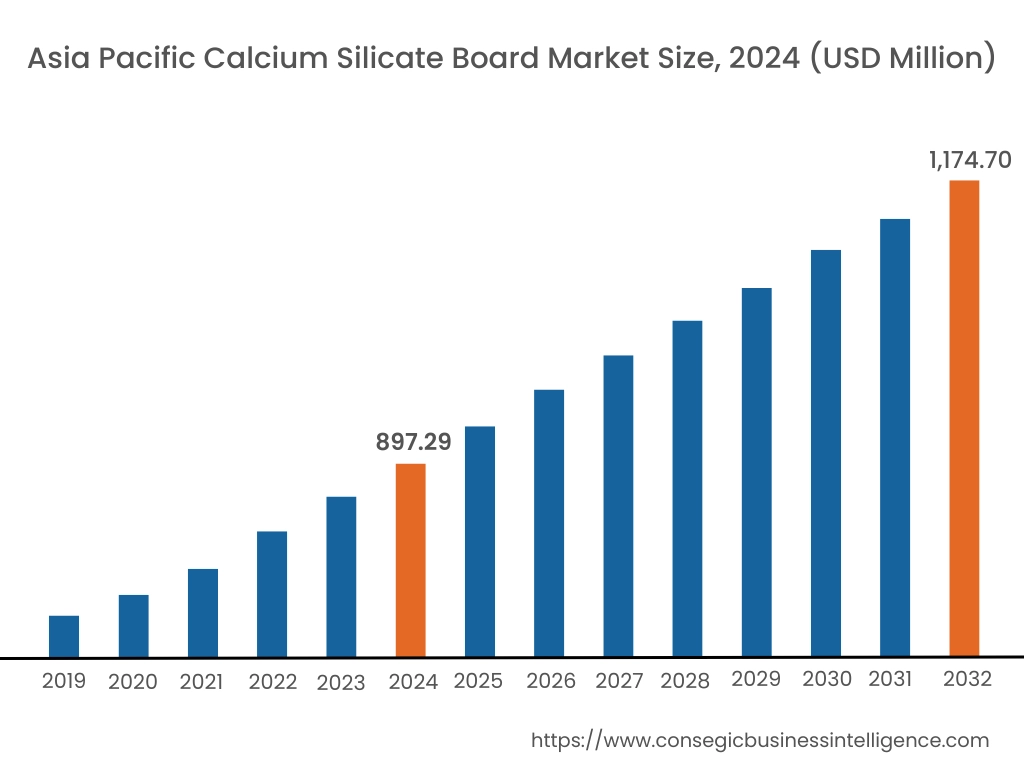

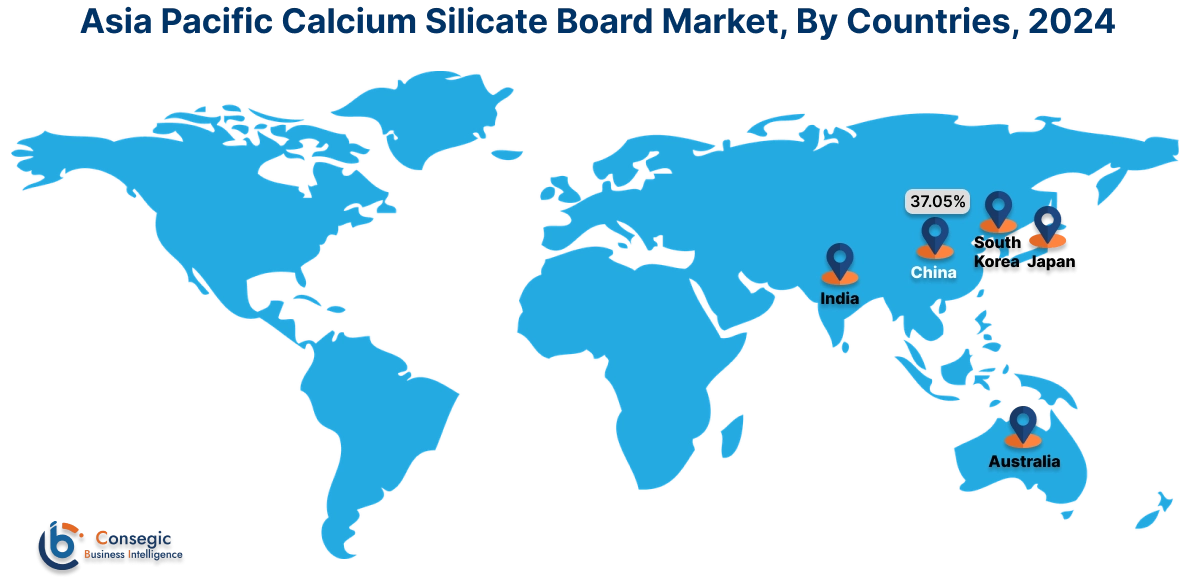

In 2024, Asia-Pacific accounted for the highest market share at 43.45% and was valued at USD 897.29 Million and is expected to reach USD 1,174.70 Million in 2032. In Asia-Pacific, the China accounted for the highest calcium silicate board market share of 37.05% during the base year of 2024. As per analysis, Asia Pacific holds a dominant position in the market due to expanding power generation facilities. The calcium silicate board is utilized in power generation plants for reducing heat loss and energy efficiency. Additionally, countries such as China, India, and Japan are major contributors in the market due to expanding manufacturing facilities for this board.

In 2022, Ramco Industries expands its manufacturing capacity of calcium silicate board in India by launching a plant with production capacity of 11.5 million square meters.

Therefore, the Asia Pacific region is dominating in the market, supporting expanding power generation facilities and growing manufacturing of board as per analysis.

Europe is expected to witness the fastest CAGR of 6.2% over the forecast period of 2025-2032. According to calcium silicate board market analysis, Europe is growing considerably driven by stringent environmental regulations and strong focus on sustainability. The region is adopting eco-friendly and non-toxic insulation material. This is driving the adoption of this board due to its recyclability and land fill disposability. The region is also implementing regulations such as Waste Framework Directive to promote non-hazardous construction further driving the market. Hence, calcium silicate board market share of Europe is expected to emerge rapidly through stringent regulations and adoption of non-toxic insulation material as per analysis.

As per calcium silicate board market analysis, the North America region is growing rapidly driven by advancements in technology. Innovation in lightweight, high-strength formulations have improved durability while maintaining fire resistance and thermal insulation properties. Further, the integration of nano-coating enhances the moisture resistance properties of this board, making it suitable in harsh environments.

The Middle East & Africa region is experiencing moderate proliferation in the market driven by growing petrochemical industry. It is driving the use of calcium silicate board for partitions and enclosures due to its durability and load-bearing capacity. The governments in the region are also investing in the petrochemical sector further leading to calcium silicate board market expansion as per analysis.

As per market analysis, Latin America is growing steadily in the market driven by rising disposable incomes and steady economic development across the region. Increasing urbanization and industrialization has led to more construction thereby driving the adoption of calcium silicate board in building materials. Countries such as Brazil, Mexico, and Argentina are leading the market supported by growing population, expanding industrialization and infrastructure development.

The calcium silicate board industry is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global calcium silicate board market. Key players in the calcium silicate board industry include-

Etex Group (Belgium)

Johns Manville (United States)

Ramco Hilux (India)

Zhejiang Xinguang Building Materials (China)

SaintGobain (France)

Skamol (Denmark)

Isolatek International (United States)

L'ISOLANTE K-FLEX (Italy)

NICHIAS Corporation (Japan)

USG Corporation (United States)

Mergers & Acquisitions:

In 2023, Etex acquired Skamol, a manufacturer of high temperature insulation materials. It is expanding the product portfolio of Etex including calcium silicate board for sustainable solutions.

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2,888.40 Million |

| CAGR (2025-2032) | 4.3% |

| By Product Type |

|

| By End Use |

|

| By Sales Channel |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|